Schloss Bangalore Limited, the company behind the iconic “The Leela” luxury hotel brand, is set to go public with its IPO, an issue of ₹3,500.00 crores. With 13 premium hotels under its belt and a strong brand heritage, the IPO provides investors a chance to be part of India’s growing luxury hospitality space.

About the Company

The company owns, operates, and manages luxury hotels and resorts under the brand name “The Leela”. The company portfolio includes The Leela Palaces, The Leela Hotels, and The Leela Resorts. Out of the 13 operational hotels, five are owned by the company, seven are managed by the company, and one hotel is owned and managed by a third party under a franchise agreement. As of March 31, 2025, the company has 3,553 keys (rooms).

The Leela brand has received global accolades, including:

- #1 hospitality brand globally in 2020 and 2021 by Travel + Leisure.

- Ranked among the top 3 globally in 2023 and 2024.

About the Sector

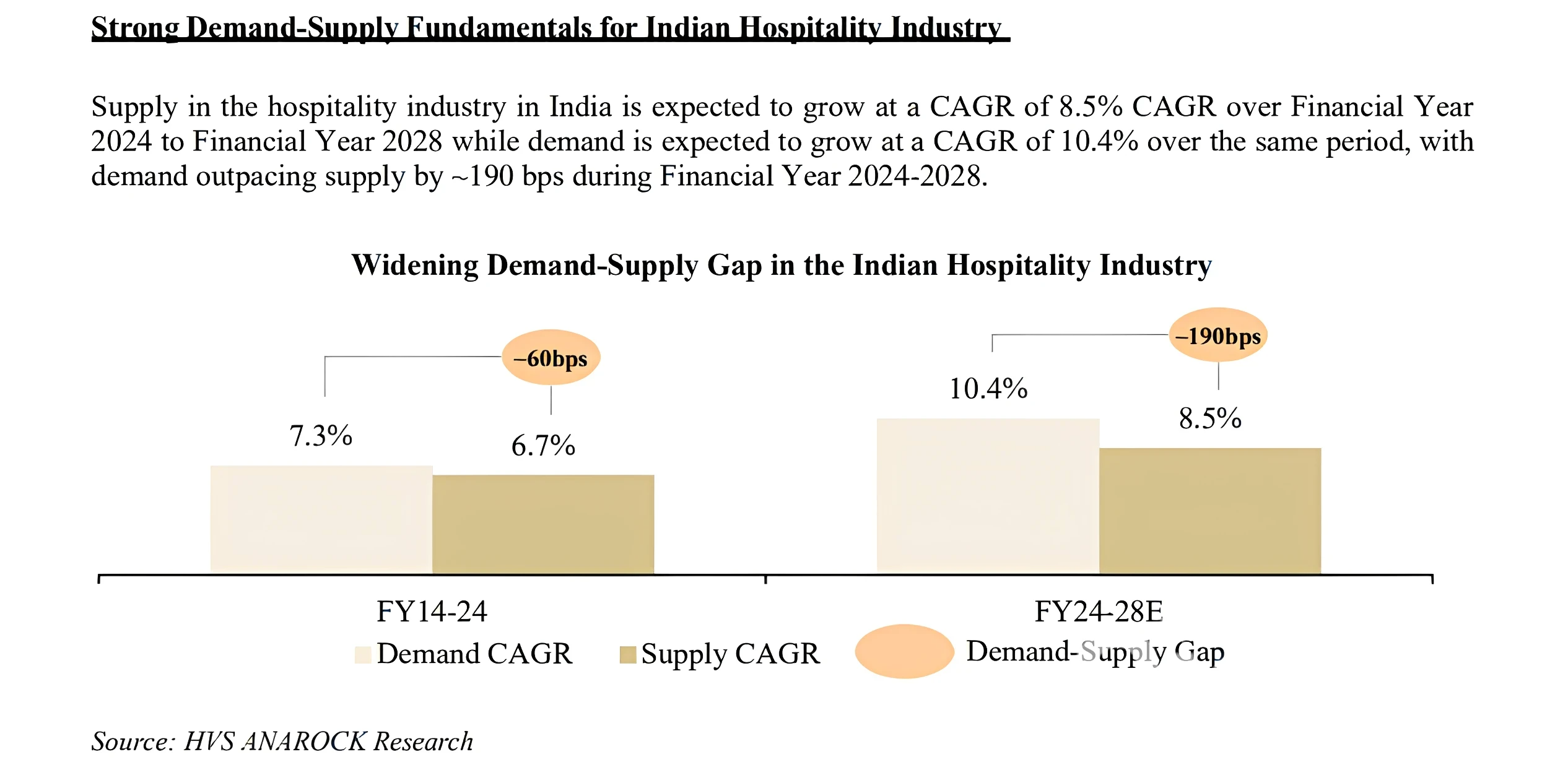

- Domestic tourist visits (DTV) are expected to grow at a 13.4% CAGR, from 2.8 billion in 2024 to 6.0 billion in 2030.

- Foreign tourist arrivals (FTAs) are expected to grow at 7.1% CAGR, from 9.7 million in 2024 to 14.6 million in 2030.

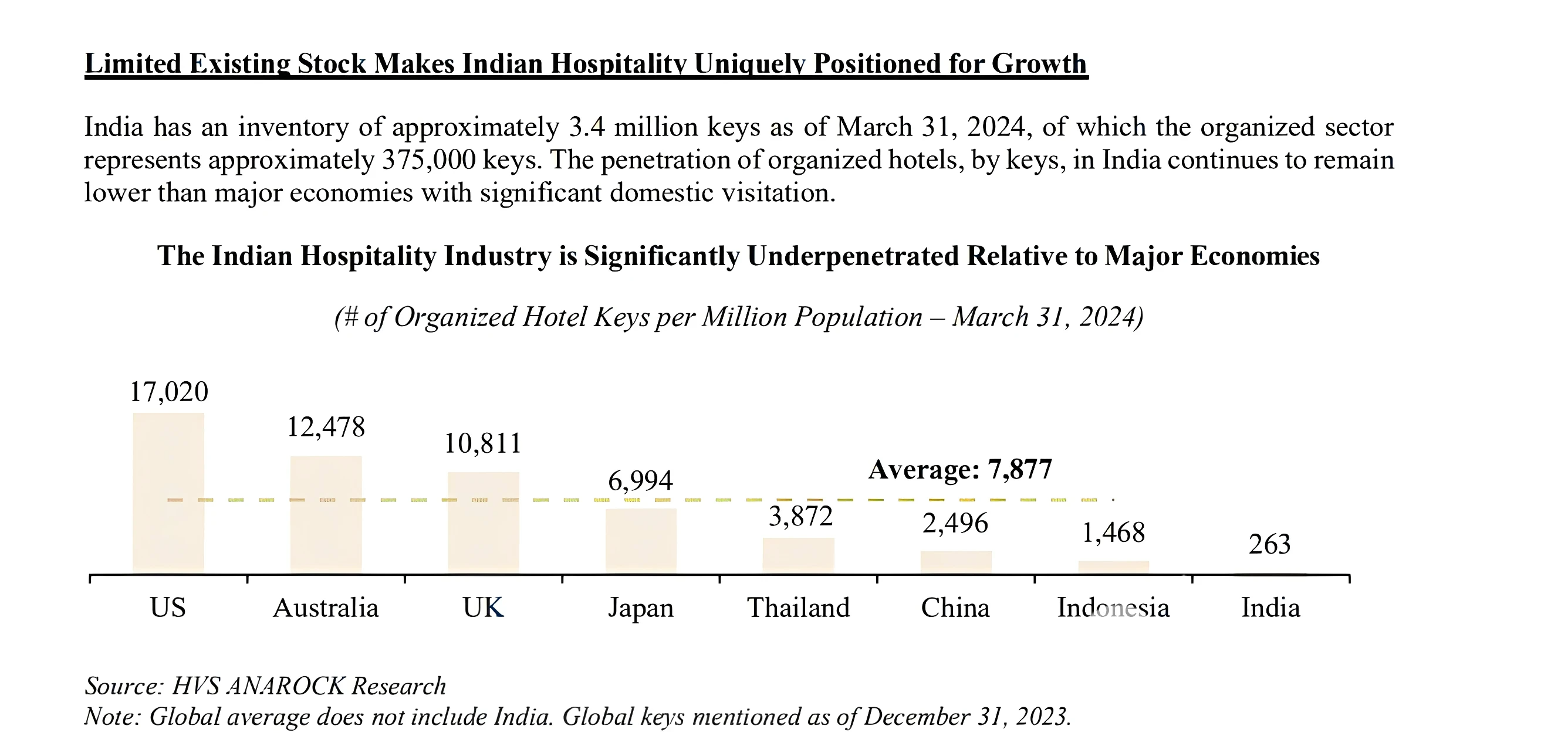

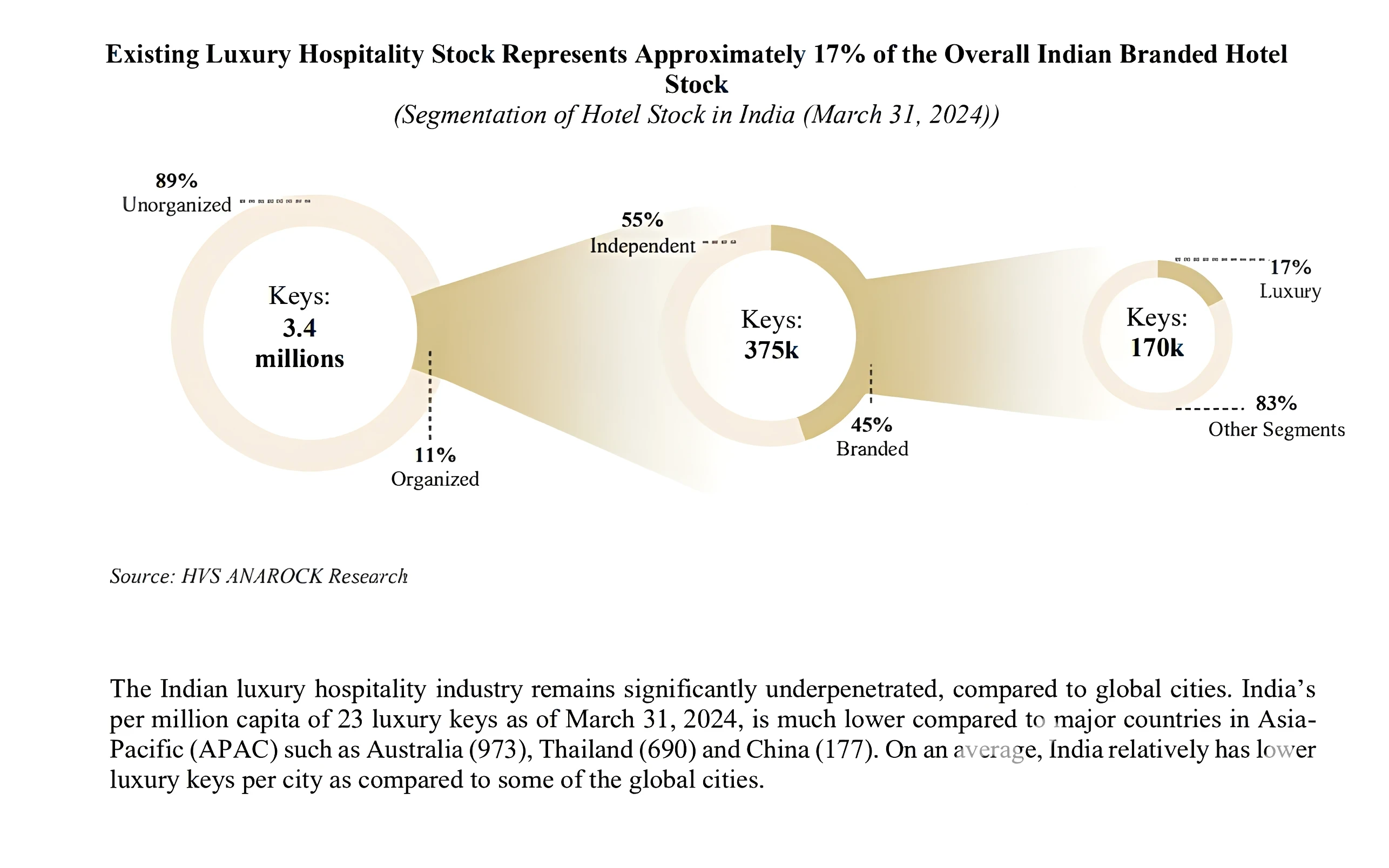

- India’s organized hotel key density was just 263 per million population in 2023, far below the global average of 7,877.

- Government infrastructure investments of $1.7 trillion are planned for 2024–2030.

- Demand is rising in luxury niches: heritage, spiritual, wellness, and MICE (Meetings, Incentives, Conferences, and Exhibitions)

Promoters and Their Experience

The promoters of Schloss Bangalore Limited are investment entities affiliated with Brookfield Asset Management, one of the world’s largest alternative asset managers with over $1 trillion in AUM.

Promoter entities include:

- Project Ballet Bangalore Holdings (DIFC) Pvt Ltd

- BSREP III Joy (Two) Holdings (DIFC) Ltd

- BSREP III Tadoba Holdings (DIFC) Pvt Ltd

- Project Ballet Chennai Holdings (DIFC) Pvt Ltd

- Project Ballet Gandhinagar Holdings (DIFC) Pvt Ltd

- Project Ballet HMA Holdings (DIFC) Pvt Ltd

- Project Ballet Udaipur Holdings (DIFC) Pvt Ltd

Objectives of the IPO

The IPO aims to raise ₹3,500 cr, including:

- Fresh Issue: ₹2,500 cr

- Offer for Sale: ₹1,000 cr

Utilization of Proceeds from the Fresh Issue:

- Repayment/prepayment of borrowings by the company and its subsidiaries.

- Capital expenditure on the development and refurbishment of hotel properties.

- General corporate purposes, including future growth initiatives

Financial Snapshot of the Last 3 Years (₹ in million)

| Metric | FY25 | FY24 | FY23 |

| Revenue from Operations | 13,005.73 | 11,714.53 | 8,600.58 |

| Other Income | 1,059.83 | 550.47 | 432.09 |

| Total Income | 14,065.56 | 12,265.00 | 9,032.67 |

| EBITDA | 7,001.68 | 6,000.26 | 4,236.29 |

| Net Profit / (Loss) | 476.58 | (21.27) | (616.79) |

Key Financial Ratios

| Ratio | FY25 | FY24 | FY23 |

| Basic / Diluted EPS (₹) | 1.97 | (0.12) | (3.50) |

| Return on Net Worth (%) | 1.32% | NA | NA |

| Net Asset Value per Share (₹) | 148.88 | (160.57) | (142.74) |

| Debt-to-Equity Ratio | 1.08 | (1.50) | (1.47) |

| Adjusted Net Debt / Equity | 0.71 | (1.34) | (1.35) |

| Debt Service Coverage Ratio | 0.63 | 1.32 | 1.05 |

Key Insights Based on Financials

- Turnaround in FY25: The company has swung from losses in FY23 and FY24 to a profit of ₹476.58 million in FY25.

- Robust EBITDA: Margins improved significantly, with EBITDA increasing from ₹4,236 million (FY23) to ₹7,002 million (FY25).

- Leverage concerns: Although debt has been reduced, the company’s historical debt-to-equity ratio was negative in FY23 and FY24.

- Strong brand loyalty: Net Promoter Score (NPS) of 11 in FY25, highest in its peer group.

Risk Factors

- Heavy reliance on five owned hotels, contributing over 90% of total income.

- High debt load despite recent repayment plans.

- Negative net worth until FY24 and only marginal profitability in FY25.

- Past cash flow issues, including negative operating cash flows in certain periods.

- Brand dependency: Reputational damage to “The Leela” can have severe business impacts.

Full list available in the RHP Risk Factors section.

IPO Details – Leela Hotels IPO

| IPO Name | Leela Hotels IPO |

| IPO Date | May 26, 2025 to May 28, 2025 |

| Issue Price Band | ₹413 to ₹435 per share |

| Lot Size | 34 Shares |

| Listing At | NSE & BSE |

| Allotment Date | May 29, 2025 |

| Listing Date | Jun 2, 2025 |

| Retail (Min) lot & Amount | 1 lot & ₹14,790 |

| Retail (Max) lots & Amount | 13 lots & ₹1,92,270 |

| Small-HNI (Min) lots & Amount | 14 lots & ₹2,07,060 |

| Small -HNI (Max) lots & Amount | 67 lots & ₹9,90,930 |

| Big-HNI (Min) lots & Amount | 68 lots & ₹10,05,720 |

Conclusion – Leela Hotels IPO

Schloss Bangalore Limited IPO (Leela Hotels) is a significant event in the Indian luxury hospitality sector. Backed by a heritage-rich Leela brand, the company is turning profitable now after years of transformation. However, the high debt and past losses are notable risks. This IPO is best suited for investors with an appetite for moderate-to-high risk, looking for exposure to India’s premium travel and hospitality.

To know more about current & upcoming IPOs, click